Why were Everton deducted 10 points by the Premier League?

In November 2023, Everton received a 10-point deduction for breaching the Premier League’s Profitability and Sustainability Rules (PSR). A sporting sanction with major consequences for the Toffees in their quest to continue their 70-year spell (since the 1954-55 season) in the English topflight.

In November 2023, Everton received a 10-point deduction for breaching the Premier League’s Profitability and Sustainability Rules (PSR). A sporting sanction with major consequences for the Toffees in their quest to continue their 70-year spell (since the 1954-55 season) in the English topflight.

It is a first such penalty since the introduction of the league’s current financial regulations in February 2013. With Manchester City also referred to the Commission for over 100 alleged breaches between 2009-10 and 2017-18, and other clubs, including Chelsea, under investigation by the league, more penalties may follow.

So, what regulations did Everton exactly breach? Why did the club receive a sporting sanction of this size? And what are the implications for Everton and other Premier League sides?

Everton’s financial loss exceeds Premier League limit

According to the Premier League, Everton breached the Profitability and Sustainability Rules (PSR) for the period ending in the 2021-22 season. PSR calculates a club’s adjusted earnings before tax for period T (the current year), T-1 and T-2. Excluded are such costs as investments in infrastructure and those classified as for the general interest of football (e.g. youth development and women’s football).

Based on the league’s PSR calculations for the period ending in the 2021-22 season, Everton demonstrated losses of £124.5 million1. An amount which exceeds the permitted loss of £105 million by £19.5. The PSR loss was adjusted from £120.8 million calculated at an earlier stage.

Everton initially denied breaching the Premier League’s allowed threshold. Their PSR calculations submitted to the league in March 2023, demonstrated an adjusted loss of £87.1 million. However, shortly before the hearing in October 2023, the club changed its stance, accepting the breach. Contrary to the £19.5 million breach calculated by the league, the Toffees argued they crossed the allowable loss by £7.9. Which became £9.7 million by the end of the hearing and is around 50 percent below the league’s calculations.

Final stance on Profitability and Sustainability Rules breach for period ending in the 2021-22 season

| Who | £105m threshold breached by… | Other |

|---|---|---|

| Premier League | £19.5 million | Aggravating factors |

| Everton | £9.7 million | Mitigating factors |

Adjustments to account for COVID-19

The period in which the breach took place coincided with the COVID-19 pandemic and its fallout on the football market. To adjust for this, PSR allowed COVID-19 costs to be excluded during the 2019-20, 2020-21, and 2021-22 seasons.

The period in which the breach took place coincided with the COVID-19 pandemic and its fallout on the football market. To adjust for this, PSR allowed COVID-19 costs to be excluded during the 2019-20, 2020-21, and 2021-22 seasons.

Furthermore, for PSR calculation purposes, financial years 2020 and 2021 were to be averaged. So, the PSR adjusted earnings before tax for the period ending in the 2021-22 season, was the total of financial year 2019, the average of 2020 and 2021, and financial year 2022.

Moshiri’s arrival

Fheinimann96fh, CC BY-SA 4.0, via Wikimedia Commons

In addition to COVID-19, there are several other factors contributing to the complexity of the case. Most can be linked back to the arrival of Ardavan Moshiri.

The British-Iranian businessman acquired a beneficial interest in Everton in March 2016. By September 2018, he had acquired a beneficial interest in the majority of the club’s share capital. While he has been the beneficial owner of more than 90 percent of the share capital since January 2022.

Timeline of Ardavan Moshiri’s involvement with Everton

| When | What |

|---|---|

| March 2016 | Acquired a beneficial interest |

| September 2018 | Acquired a beneficial interest in the majority of the share capital |

| January 2022 | Beneficial owner of more than 90 percent of the share capital |

| January 2023 | Exploring options to sell (a part) |

Moshiri’s ambitions were two-fold. Firstly, for Everton to become a top Premier League team and a regular in Europe. Secondly, to build a new stadium.

From spending to become a top team to avoiding relegation

To become a top Premier League team and a regular in Europe, the club increased its spending to improve the squad’s quality. Hoping it would lead to on-field success and the subsequent positive impact on revenue. In addition, player investments would result in higher revenue from player sales in the future.

However, where investments were made to climb the Premier League table in the beginning, it has become a must to prevent a first-time relegation (as one of only six clubs) from the Premier League in recent seasons.

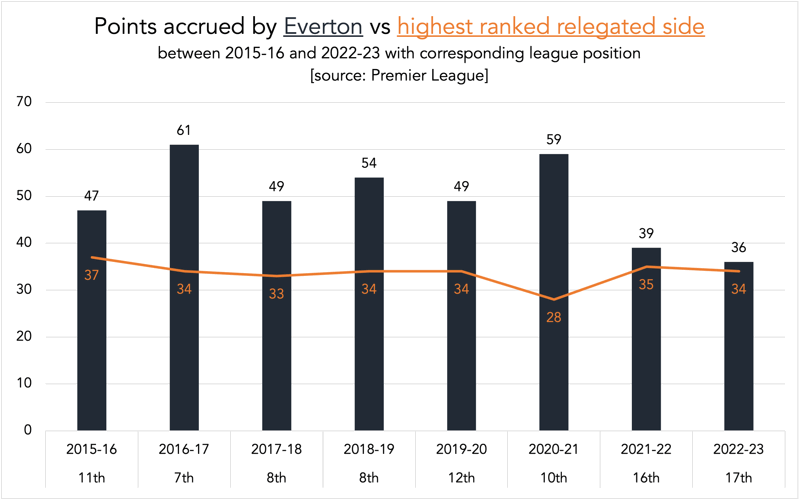

In 2016-17, Moshiri’s first season, Everton finished seventh with 61 points. A 30 percent increase compared to the season prior. The following seasons the club performed at a reasonable level but did not achieve regular European football nor the top of the Premier League. The opposite has happened. While spending to move up, Everton has been fighting relegation during the 2021-22 and 2022-23 seasons with a 16th (four points margin) and 17th (two points margin) league finish respectively.

High manager turnover

Lynchg at en.wikipedia, CC BY-SA 3.0, via Wikimedia Commons

Disappointing results have resulted in a high manager turnover. Sean Dyche, appointed in January of 2023 (before the breach was referred to the independent Commission), became the eighth coach to lead the Toffees since Moshiri’s involvement in 2016.

It has led to high overall staff cost, including severance packages.

In 2021-22, changes to the coaching staff cost the club £10.5 million5. Which made up six percent of Everton’s £172.5 million in total wage costs.

Negative transfer spending

To improve the squad, Everton has spent a significant amount on new players. According to CIES Observatory, the Toffees have a negative transfer spend of €392 million between 2014 and 2023. Ranking them as 15th worst across Europe.

During that time, the club invested €1,028 million on players, while receiving €636 million in sales. Since 2019, they have a negative spend of €108 million.

Everton transfer spending between 2014 and 2023 [source: CIES Observatory]

| What | Amount |

|---|---|

| Investments | €1,028 million |

| Receipts | €636 million |

| Net spending | €392 million |

Especially in Moshiri’s early years, many major investments were made. Between 2016-17 and 2020-21, 18 players were acquired for a transfer sum above €20 million. The only prior acquisition over €20 million was Romelu Lukaku from Chelsea for around €35 million in 2014. Moshiri’s record signing came in August 2017, with the acquisition of Gylfi Sigurdsson from Swansea for €49.4 million.

Tightening the belt after rising wage costs

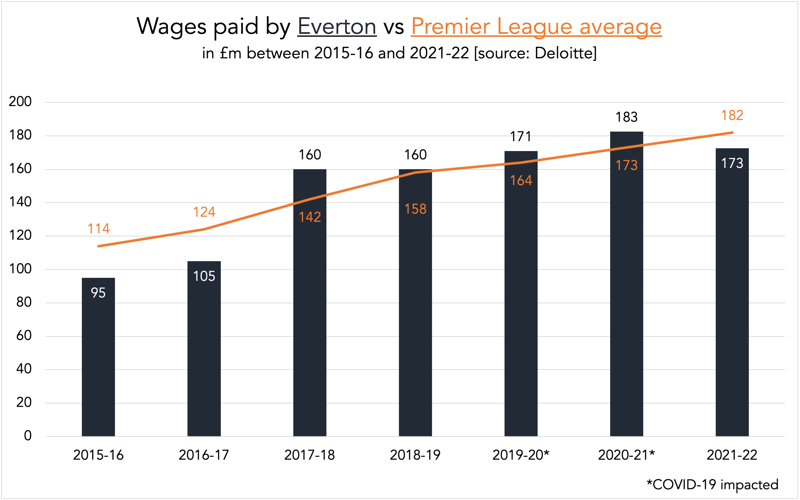

Apart from higher transfer spending, the club’s wages also increased significantly during those years. By 2021-22, wage costs had increased to £173 million5. An 82 percent increase compared to the £95 wage bill in 2015-162.

In Moshiri’s second season (2017-18), wages increased to a massive £160 million, 53 percent higher than the season prior. Causing Everton to have the league’s sixth highest wage bill and together with the Big Six, the only clubs to spent above the league’s average of £142 million. The Toffees spent 12.7 percent (£18 million) more on wages than the average side that season.

For four consecutive seasons, Everton outspent the average Premier League side on wages. Due to financial constraints, and the foresight of possible sanctions, they reduced their wage bill by 6 percent to £173 million in 2021-22.

Drop in revenue after growth

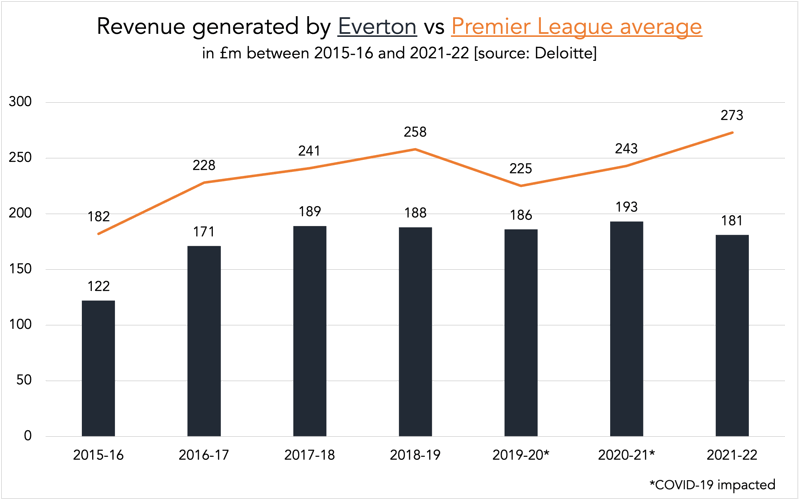

Higher wage (and transfer) costs do not necessarily have to be a problem though if revenue rises at the same or a higher pace. Everton did indeed see their revenue rise (48 percent) from £122 million in 2015-162 to £181 million in 2021-225. This mirrors the increase (50 percent) in average revenue across the league. During 2015-16, Everton were the 11th highest revenue generating Premier League side, while they ranked 10th in 2021-22.

Especially during the 2016-17 season3, Moshiri’s first full season, Everton increased its revenue significantly with 40 percent. This while the average Premier League side generated 25 percent more. However, the £181 million revenue in 2021-22 was the lowest amount the club has generated since 2016-17 (£171 million). It was also six percent down compared to the 2020-21 season.

Compared to the average revenue generated in the league, Everton only dropped one percent in revenue during the COVID-19 hit 2019-20 season. While matchday (£2.7 million, 18 percent) and broadcast (£35.7 million, 27 percent) revenue declined, as it did for most clubs, commercial revenue doubled from £37.2 million to £76 million. Most of which came from securing a one-off £30 million naming option with USM Holdings for the club’s new stadium.

Wages to revenue ratio

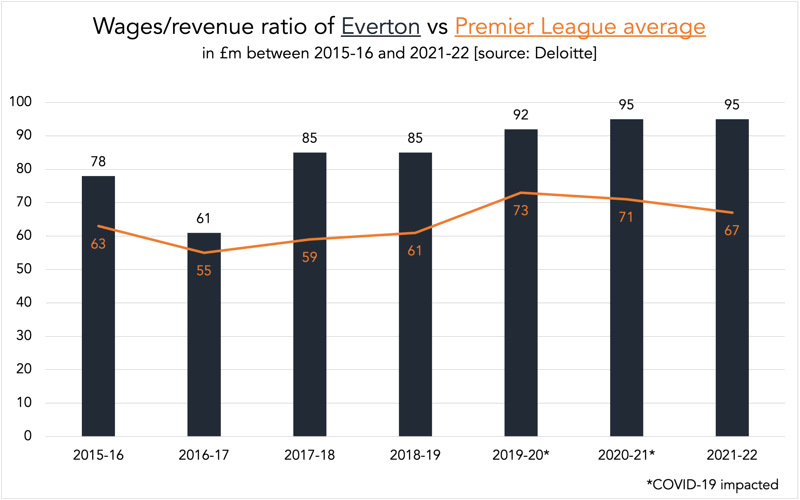

In recent years, however, the club has spent too much relative to their revenue in a bid for on-field success. Leading to a financially unhealthy situation.

One indicator of this, is Everton reporting wages to revenue ratios above the healthy limit of 70 percent in recent seasons. During the 2015-16 season, the ratio was at 78 percent2, which dropped to a healthy 61 percent3 the following season due to higher revenue. Yet, since 2017-18, it has not been below 85 percent.

COVID-19 caused ratios to rise for many clubs as (matchday and broadcast) revenue took a hit. Due to the deal with USM Holding, Everton’s revenue remained steady in 2019-20. Nevertheless, their ratio worsened to 92 percent4 as wages increased by £12 million (seven percent). Despite lowering wages in 2021-22, they still recorded an alarming ratio of 95 percent5.

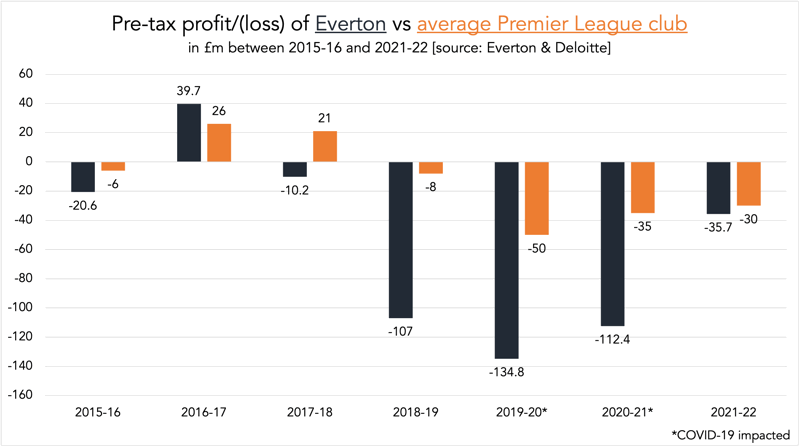

Running pre-tax losses

In six out of seven seasons between 2015-16 and 2021-22, Everton recorded pre-tax losses. Their only pre-tax profit was during the 2016-17 season with £39.7 million. £13.7 million more than that of the average Premier League side. Since then, their numbers are worrisome and below the league’s average.

During the PSR-period (2018-19, average of 2019-20 and 2020-21, and 2021-22) in which the club has breached regulations, their pre-adjusted PRS loss was £266 million.

New stadium causing financial problems

James T M Towill / Victoria Tower and construction of the new Everton Stadium

Besides investing in squad quality, Moshiri’s aspired to build a new stadium. Construction on the 52,888-capacity stadium at Bramley-Moore Dock started in August 2021 and is expected to be completed by late 2024.

Estimated cost of the whole project stood at £500 million. However, the costs incurred prior to obtaining planning permission caused Everton problems. Due to the location being a UNESCO World Heritage site, the pre-planning permission costs were significant. By January 2021, the club stated they had already invested around £54 million1 into the new stadium.

With no planning permission the benefits are not yet probable, and therefore costs cannot be capitalised. They will thus show up in the profit and loss account and in the PSR calculations. Other clubs redeveloping their stadiums could capitalise such costs. The league produced a report that month stating that Everton was in breach of the PSR maximum allowed loss of £105 million but would comply with regulations if stadium costs were excluded.

Only in February 2021, did the club receive planning permission. Allowing Everton to capitalise stadium costs from June 2020 onwards. The £39.3 million1 incurred prior to that date could not, however. In August 2021, the league reached an agreement with Everton to be lenient with the costs if the club did not breach their adjusted PSR threshold.

Difference in breach size

The difference between the size of the breach (the league’s £19.5 million and Everton’s £9.7 million) is attributable to two factors1.

The first dispute concerned a four percent levy on player transfer fees paid to the league. These levies are redirected to the player pension plan first, and any surplus is invested in youth. Since clubs can normally subtract youth development costs from PSR calculations, Everton believed their surplus (£5.8 million) should not have been included. However, the Premier League stated that these are the league’s expenditures, and not those of clubs.

The second dispute concerned commercial loan agreements of £150 million1 (as of June 2022). Intended for the club’s use, they in turn lent it interest-free to Everton Stadium Development Ltd (a wholly owned subsidiary of Everton FC) who oversees the new stadium construction. The club sought to exclude interest charges as they related to stadium financing and were therefore excludable from PSR calculation. However, the league believed it to be outside the scope of their previous agreement. Furthermore, contrary to statements from the club, the loans’ name party and beneficiary was Everton FC.

Aggravating and mitigating factors in dispute

Empty stadiums during Covid-19

According to the Premier League the size of the breach was one of several aggravating factors. Most importantly, the league believed Everton overspent on players and thereby failed to reduce expenditures.

Everton, in turn, named multiple mitigating factors. First, they believed post-planning permission interest charges of £9.3 million1 were not treated as capital expenditure but could have. Yet, the league did not believe these costs were in relation to the stadium.

Furthermore, Everton claimed to have missed out on income. First, by foregoing a claim for losses of £10 million against a player’s whose contract had been terminated. Secondly, due to COVID-19’s impact on their ability to sell players and thereby improve their financial position. And finally, Russia’s invasion of Ukraine significantly impacted the club’s investment and sponsorship income.

However, according to the league uncertainty around the probability and amounts missed out on, diminished these arguments’ strength. In addition, COVID-19 affected all clubs and clubs could already exclude most of these costs.

A final mitigating factor asserted by Everton, is that their adjusted PSR losses showed a positive trend.

Commission’s verdict

The Commission highlighted in their verdict that PSR are in place to promote financial stability and sustainability amongst Premier League clubs by limiting the losses they can incur. The aim is for clubs to break even or generate a profit. So, although the PSR loss is permitted to be up to £105 million over three seasons, the target is a nil PSR loss. The buffer is in place in case of emergency. The £19.5 million breach is therefore significant according to the Commission.

The Commission highlighted in their verdict that PSR are in place to promote financial stability and sustainability amongst Premier League clubs by limiting the losses they can incur. The aim is for clubs to break even or generate a profit. So, although the PSR loss is permitted to be up to £105 million over three seasons, the target is a nil PSR loss. The buffer is in place in case of emergency. The £19.5 million breach is therefore significant according to the Commission.

Everton’s breach has resulted in a sporting advantage that is difficult to quantify. However, it is to the detriment of competing PSR-compliant clubs. A sanction must therefore punish the offender, while vindicating compliant clubs. Furthermore, it must deter clubs tempted to breach PSR believing it could have lasting (sporting) benefits. While it must also protect the integrity of the game.

The Commission believed that Everton took unwise risks by persisting on acquiring new players. Especially given their poor PSR status and an earlier agreement with the Premier League after stadium costs caused them to breach PSR. However, they did not believe the club deliberately breached PSR as the club believed they would comply.

The Premier League also made no allegations of dishonesty on the club’s part, but to act in the utmost good faith is a prerequisite. The Commission saw Everton’s inability to do so as an aggravating factor.

They also dismissed several of Everton’s mitigating factors based on that they were not certainties. Like the £10 million loss of a claim, missing out on sponsorship income due to the Russian invasion of Ukraine, and COVID-19 impacting the sales of players. These are situations caused by the market, and part of football and business management in general.

Contrary to the league, they did believe Everton showed a positive trend in their finances which was a limited mitigating factor.

Determining the size of the sanction

The sporting sanction of a10-point deduction imposed by the Commission is the largest in Premier League history and thus based on the size of the breach and relevant aggravating and mitigating factors.

The sporting sanction of a10-point deduction imposed by the Commission is the largest in Premier League history and thus based on the size of the breach and relevant aggravating and mitigating factors.

The Commission had no clear-cut prior examples nor definite Premier League regulations on the size of the sanction. The English Football League does have sanction guidelines in place for P&S regulations breaches since 17 September 2018. Which comes down to a 12-point deduction that can be reduced based on the size of the breach and mitigating factors.

On 10 August 2023, the Premier League adopted a by them deemed appropriate sanction policy in the form of a sporting sanction. And while not a binding formula, it starts at a six-point deduction. Adding one extra point for every £5 million further over the PSR threshold. Aggravating and mitigating factors could adjust the penalty.

Sanction guidelines for financial regulation breaches

| League | Sanction | Note |

|---|---|---|

| Premier League | 6-point deduction

Extra point for every £5m further breach Consider aggravating and mitigating factors |

Submitted view, but not a binding policy |

| English Football League | 12-point deduction

Consider aggravating and mitigating factors |

Stipulated in regulations, but not binding |

However, not binding and not yet written down in the regulations, the Commission forewent the option of following a structured formula and decided on the penalty size themselves.

Previous sporting sanctions

It is only the third time that a point deduction for a Premier League club is enforced. During the 1996-97 season, Middlesbrough were docked three points for foregoing a fixture against Blackburn. While Portsmouth received a nine-point penalty for going into administration during the 2009-10 season. Both clubs were unable to avoid relegation.

It is only the third time that a point deduction for a Premier League club is enforced. During the 1996-97 season, Middlesbrough were docked three points for foregoing a fixture against Blackburn. While Portsmouth received a nine-point penalty for going into administration during the 2009-10 season. Both clubs were unable to avoid relegation.

Financial irregularities also resulted in a 12-point deduction, FA Cup ban and fine for Tottenham Hotspur during the 1994-95 season. However, appeals caused all punishments to ultimately be overturned.

Points deductions in the Premier League

| Club | Season | Points deducted | Reason |

|---|---|---|---|

| Middlesbrough | 1996-97 | 3 | Foregoing a fixture |

| Portsmouth | 2009-10 | 9 | Going into administration |

| Everton | 2023-24 | 10 | Profitability and Sustainability Rules breach |

Everton’s relegation chances

The 10-point deduction caused Everton to drop from 14th with 14 points to 19th with four points. According to Opta, the club’s relegation chances increased by 30.6 percent point to 34.1 percent. Slightly lower than the 34.4 percent chance (fourth highest) Everton had before the season started.

By winning four out of five matches between the sanction and Christmas, the Toffees reduced their relegation chances to 3.7 percent. However, losses over the festive period worsened their chances by 15.1 percent point to 18.8 percent.

Everton’s chances of relegation during the 2023-24 season [source: Opta]

| When | Chance of relegation (%) |

|---|---|

| Start 2023-24 season | 34.4% |

| Prior to 10-point sanction | 3.5% |

| After 10-point sanction | 34.1% |

| 22 December 2023 | 3.7% |

| 2 January 2024 | 18.8% |

Further fallout

The Commission’s verdict does not only have on-field implications. Possible relegation reduces revenue significantly. During the 2021-22 season, the average revenue of a Premier League side was £273 million5. While this was £28 million (just 10 percent) in the Championship.

The Commission’s verdict does not only have on-field implications. Possible relegation reduces revenue significantly. During the 2021-22 season, the average revenue of a Premier League side was £273 million5. While this was £28 million (just 10 percent) in the Championship.

Fulham and West Brom, who were relegated in 2020-21, recorded a revenue drop of £49.0 million and £41.5 million respectively. Which is around 25 percent of the revenue Everton generated during the 2021-22 season.

To be compliant in the future, and prevent further sanctions, the club needs to improve their finances. Possibly affecting their on-field performances as well.

Teams fallen victim to Everton’s sporting advantage

Furthermore, the Commission stated that Everton achieved a sporting advantage in the seasons between 2018-19 to 2021-22 on which the PSR calculations were based. During the first three seasons, a ten-point deduction would not have made a difference sporting wise. Merely financially due to revenue generated based on results.

However, during the 2021-22 season, Everton finished 16th, four points clear of relegation. Burnley, Watford, and Norwich City were the teams relegated that season.

Due to the case’s postponement (and sanction) to 2023-24, the sides (Leicester City, Leeds United, and Southampton) relegated in 2022-23 have a case as well. Leicester City would have avoided relegation had the sanction been imposed during the previous season.

Financial compensation is the most these clubs could wish for. If granted, it would worsen Everton’s, already precarious, financial situation.

Appeal and more to follow

It is clear now that financial breaches when provable will be punished severely with sporting sanctions. In their statement following the sanction, Everton announced it would appeal the decision and closely follow what happens with other ongoing investigations.

It is clear now that financial breaches when provable will be punished severely with sporting sanctions. In their statement following the sanction, Everton announced it would appeal the decision and closely follow what happens with other ongoing investigations.

However, this case made it clear there are no two cases alike and no one uniform sanction with so many different factors to account for. Hopefully, it will deter clubs from overspending and lead to a financially healthier and more sustainable football market.

Sources: