Newcastle United Spending, Revenue & Investments Since Saudi PIF Takeover

A consortium led by the Saudi Arabian Public Investment Fund (PIF) took over Newcastle United for a reported £305 million in October 2021. A controversial takeover, long in the making with political interference in both England and the Middle East.

A consortium led by the Saudi Arabian Public Investment Fund (PIF) took over Newcastle United for a reported £305 million in October 2021. A controversial takeover, long in the making with political interference in both England and the Middle East.

The deal was only worth seven percent of the reported £4.25 billion a consortium led by Todd Boehly and private equity firm Clearlake Capital paid for Chelsea in May 2022. Yet, with a long-term vision ‘to top the Premier League’ it is an intriguing investment in a club with a rich history, loyal fan base and thus with business and competitive potential.

How well have Newcastle fared, on and off the pitch, since the takeover? What has changed and what does the future hold for the Magpies?

Road to takeover

Since the Premier League came into existence in 1992-93, Newcastle United has competed with the best on multiple occasions. After gaining promotion to the highest division during the 1992-93 season, they achieved two second and one third place league finishes in the following four seasons. Between 2001-02 and 2003-04, Newcastle earned a fourth, third and fifth place Premier League finish.

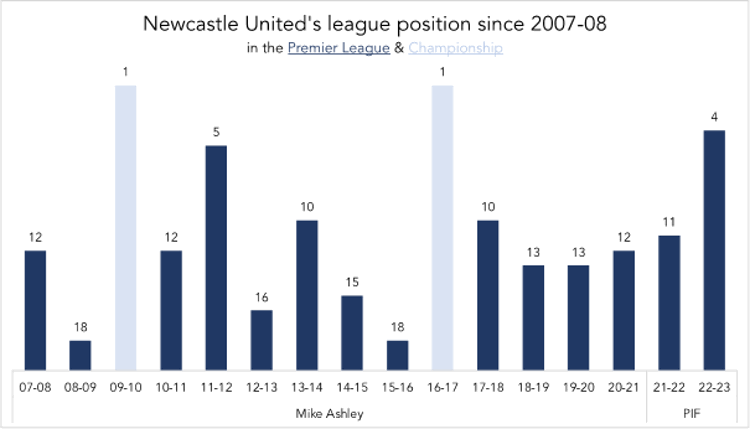

In May 2007, British businessman Mike Ashley took control of Newcastle United for £134 million. He subsequently delisted the club from the London Stock Exchange. During his tenure as owner, the club was relegated to the Championship on two occasions (2008-09 and 2015-16). Both times the club gained promotion back to the Premier League at the first opportunity. Apart from a fifth-place finish during the 2011-12 season, Newcastle did not finish a Premier League season above tenth place.

Achievements were under par compared to fans’ expectations and desire. Fans did not believe Ashley invested enough nor made the right decisions to improve the club. They made no secret of wanting the businessman out.

Ashley put the club up for sale on multiple occasions (September 2008 and October 2017), only to reconsider his decision due to low valuations. When he finally sold the club in October 2021, it made an end to his 14-year reign at the club. To the delight of fans, who saw the period as ‘disastrous’.

Consortium led by PIF

Newcastle United’s new owners are a consortium consisting of the Saudi Public Investment Fund (PIF), PCP Capital Partners and RB Sports & Media. PIF provided 80 percent of the funds for the takeover. One that most fans welcomed. According to a Newcastle United Supporters’ Trust (NUST) survey, 93.8 percent of its members were in favour of the takeover. While that was even 97 percent the year prior.

Newcastle United’s new owners are a consortium consisting of the Saudi Public Investment Fund (PIF), PCP Capital Partners and RB Sports & Media. PIF provided 80 percent of the funds for the takeover. One that most fans welcomed. According to a Newcastle United Supporters’ Trust (NUST) survey, 93.8 percent of its members were in favour of the takeover. While that was even 97 percent the year prior.

The takeover was not without challenges though. Hence, the 18 months it took to complete. At the time of the official announcement, the sale still came as a surprise as an arbitration case was planned for the beginning of 2022.

The biggest challenge to passing the Premier League owners’ and directors’ test was that PIF, the main consortium party, is state owned. Furthermore, a piracy dispute existed with Qatar based broadcaster beIN Sports. The latter was resolved and when the Premier League received ‘legally binding assurances’ that the Saudi state would have no control over the club, it approved the takeover.

New owners’ objective

O ne person behind the consortium is financier and owner of PCP Capital Partners Amanda Staveley. The British native was clear about the new owners’ objective for the club, to top the Premier League and ‘to create a consistently successful team that’s regularly competing for major trophies and generates pride across the globe.’ However, that this requires a long-term approach and investment was emphasized as ‘trophies need investment, time, patience and team work.’

ne person behind the consortium is financier and owner of PCP Capital Partners Amanda Staveley. The British native was clear about the new owners’ objective for the club, to top the Premier League and ‘to create a consistently successful team that’s regularly competing for major trophies and generates pride across the globe.’ However, that this requires a long-term approach and investment was emphasized as ‘trophies need investment, time, patience and team work.’

Apart from on-field success, the new owners intend to (re-) establish a true community club and improve the bond and communication with fans. Moreover, they want to invest in the city of Newcastle and ‘deliver long-term sustainable growth.’

Objectives of Newcastle United’s new owners

| Trophies – top of the Premier League and Europe |

| Establish a true community club, including improved communication with fans |

| Deliver long-term sustainable growth for the local area |

| Restructure the club |

| Invest in club infrastructure |

Appointment of new manager

The takeover gave fans back ‘hope and belief’ in the club and the performances on the field so far have not diminished that.

The takeover gave fans back ‘hope and belief’ in the club and the performances on the field so far have not diminished that.

Newcastle spent the majority of the 2021-22 season’s first half in the relegation zone. After the takeover, the Saudi-led consortium parted ways with Steve Bruce and appointed Eddie Howe on November 8th. The English manager had previously managed Bournemouth for 457 matches across two stints. During that time, he achieved promotion with the Cherries from the English fourth tier to the Premier League.

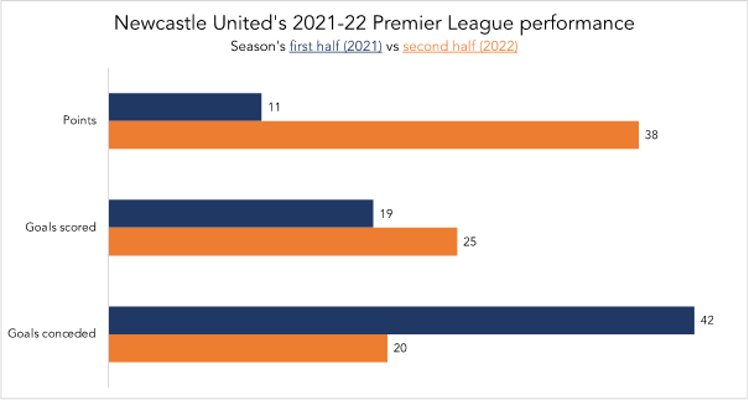

Howe’s first games in charge of Newcastle United did not drastically improve the club’s results with one win and three draws in eight Premier League matches. However, the club’s performance considerably improved in the second half of the season.

Improvement

In the first 19 league matches (all in 2021), the club won only once while drawing eight times. During the season’s second half in 2022, they won 12 matches out of 19, while drawing a further two. Their points per match increased from 0.58 to 2. Which was higher than the 1.95 points per match number three Chelsea obtained during the 2021-22 season.

While Newcastle scored 32 percent more goals in the second half of the season (25) than in the first half (19), it was their defensive record that improved even more. In the first 19 matches, Newcastle had conceded 42 goals, while this reduced by over 50 percent to 20 in the season’s second half. The defensive improvement was key in avoiding relegation, with the club eventually finishing 11th.

Impactful first transfer window

SonoGrazy, CC BY-SA 4.0, via Wikimedia Commons

During the 2021-22 winter transfer window, the new owners did not shy away from investments to improve the squad, avoid relegation, and build for the future. They brought in five major signings during that first window, three of which were defensive reinforcements.

Bruno Guimarães became the biggest incoming transfer. The club paid €42.1 million to Olympique Lyon for the Brazilian defensive midfielder. During the remainder of the 2021-22 season, he played 1032 minutes across 17 Premier League matches. Dan Burns and Matt Targett (initially on loan) both played 1440 Premier League minutes, becoming an integral part of the team. While Kieran Trippier would have made the same impact had he not missed 12 Premier League matches with a metatarsal fracture.

The second biggest signing that winter was Chris Wood. The centre forward switched from Burnley and scored twice across 17 matches (1328 minutes).

Apart from Trippier, the major signings all played most, if not all, the matches and thus made an impact. Noticeable by the club’s significant improvement in performance, in particular their defensive record, during the second half of the season.

First final since 1999 and UCL qualification

During the 2022-23 season, the first full season after the takeover, Newcastle earned 1.87 points per match. It resulted in a fourth-place league finish and thus qualification for the 2023-24 Champions League. With 68 goals scored, the Magpies ranked sixth amongst Premier League sides. Whilst their 33 goals conceded tied them with Manchester City as team with the best defensive record.

Compared to the 2021-22 Premier League season, the team scored 55 percent more goals, while conceding 47 percent less. Furthermore, Newcastle reached the final of the EFL Cup, their first final since 1999. In it, they lost 2-0 to Manchester United.

Measuring up to the Big Six

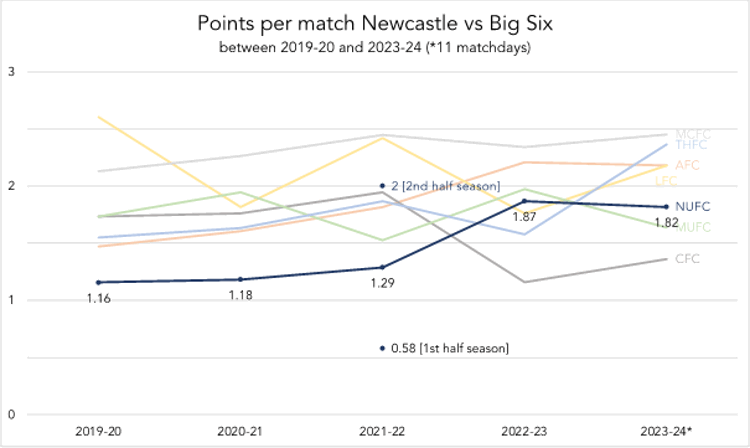

To top the Premier League and Europe, as is the main long-term objective, Newcastle needs to perform at a high level and consistently. In the Premier League that means mostly measuring up to the Big Six.

In 2022-23, they were tied with City for the least number of losses and least number of goals conceded. However, they drew 14 times, tied most with Brentford.

Since 2013-14, the Premier League champions obtained at least 81 points during the season, which comes down to 2.13 points per match. Across those seasons, the champions on average obtained 2.4 points per match.

With points per match of 1.87 in 2022-23 and 1.82 so far in 2022-23 (after 11 matches), Newcastle has found a place near the top of the table. Would they maintain such a points per match average, they are there to stay as well. As four of the Big Six averaged a lower points per match between 2019-20 and 2022-23. Only City (2.3) and Liverpool (2.15) obtained more points per match during that period.

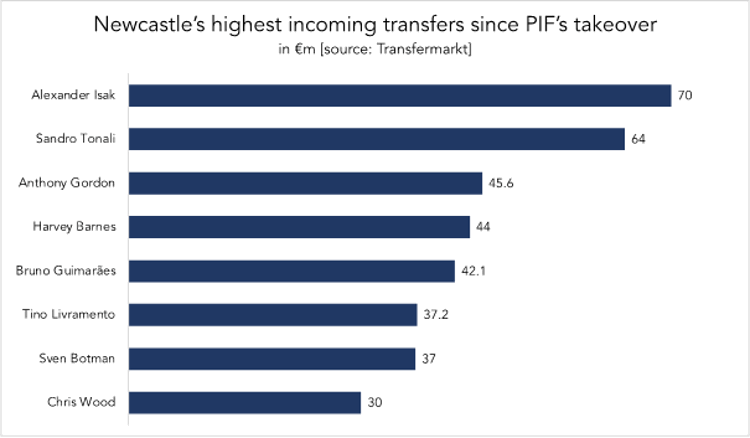

Investments in squad quality

To win trophies, the club needs to further improve the squad’s quality and thus acquire talented players. Since the takeover in October 2021, the club has spent around €440 million on incoming transfers during four transfer windows. Compared to the near £1 billion Chelsea’s new owners invested during three windows, it is modest. However, logical since clubs must adhere to financial sustainability regulations.

So far, the new owners have mostly invested in players that continue to add value to and improve the squad. During the first match of the 2023-24 Premier League season, Newcastle’s starting eleven consisted of eight players that arrived at the club since PIF took over. Moreover, three more ‘PIF-bought’ players were on the bench.

Chris Wood is the exception. The club bought the striker for €30 million in January 2022, but he left for Nottingham Forest after a year. The Magpies received a €17 million-fee in the summer of 2023 after an initial loan fee of €4.5 million.

After the first window, most players brought in were 25 years or younger. Which suggests planning with respect to costs, the future and possible resale values.

This could also be observed in the acquisition of 18-year-old Yankuba Minteh from Odense BK. Newcastle immediately loaned out the right winger to Dutch side Feyenoord. A tactic common for big clubs with an eye to the future.

Newcastle United’s major signings since PIF’s takeover

| Player | When | From | Transfer fee |

|---|---|---|---|

| Bruno Guimarães | Winter 2021-22 | Olympique Lyon | €42.1 million |

| Chris Wood | Winter 2021-22 | Burnley | €30 million |

| Alexander Isak | Summer 2022-23 | Real Sociedad | €70 million |

| Sven Botman | Summer 2022-23 | Lille | €37 million |

| Anthony Gordon | Winter 2022-23 | Everton | €45.6 million |

| Sandro Tonali | Summer 2023-24 | AS Milan | €64 million |

| Harvey Barnes | Summer 2023-24 | Leicester City | €44 million |

| Tino Livramento | Summer 2023-24 | Southampton | €37.2 million |

Rising wage bill

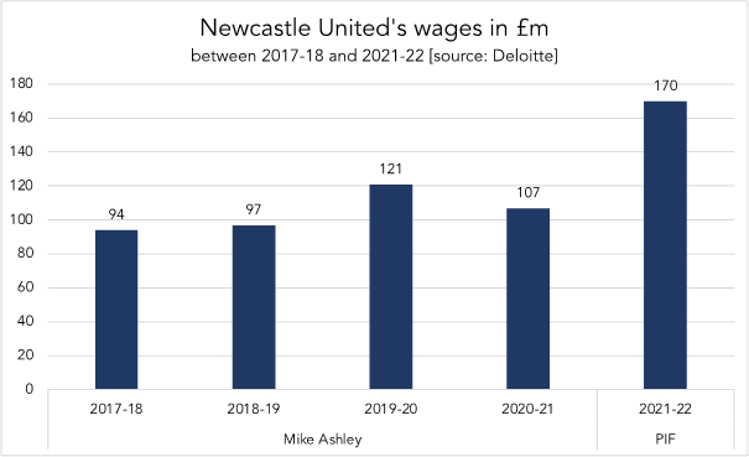

Contracting high quality players will generally also increase wage costs, in addition to higher transfer sums. In 2021-22, wage costs rose to £170 million. A 59 percent increase compared to the £107 million wage bill in 2020-21. While Newcastle had the 17th highest Premier League wages during the season prior to the takeover, they had the ninth highest during the 2021-22 season. Only behind the Big Six, Leicester City and Everton.

Furthermore, Newcastle’s wages to revenue ratio increased to an unhealthy 94 percent. Only Everton had a worse ratio with 95 percent. An important measure, as it is used by governing bodies to assess a club’s financial position. UEFA’s squad cost rule dictates that by 2025-26, relevant wages may not exceed 70 percent of relevant income.

Prior to COVID-19, Newcastle had a healthy, wages to revenue ratio of 52 (2017-18) and 55 (2018-19) percent. During COVID-19, it worsened due to mostly lower revenue. However, in 2021-22, a higher wage bill caused it to worsen.

Adhering to financial sustainability regulations, including the squad cost rule, is required to compete in European competitions. Spending is thus limited to the revenue the club generates. An amount that will rise due to on-field success, (possible consistent) European football, and commercial projects.

Generating revenue

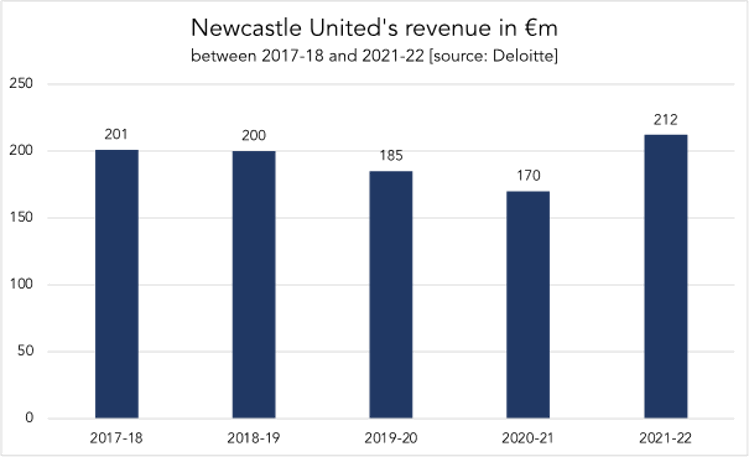

During the 2021-22 season, in which the new owners took charge of the club, total revenue reached €212.3 million (£180 million). The highest amount generated by the club between 2017-18 and 2021-22. It ranked the Magpies as 20th highest revenue generating club worldwide and 11th amongst English sides.

Manchester City ranked first with a total revenue of €731 million. Newcastle generated 29 percent compared to the 2022-23 treble winners. While they generated 35 percent of the average revenue of the Premier League’s Big Six.

The bulk of Newcastle’s 2021-22 revenue, 70 percent, came from broadcasting revenue. While matchday and commercial revenue equally split the other 30 percent.

The high income from Premier League broadcasting rights causes that 12 out of the 20 highest revenue generating clubs in 2021-22 come from the Premier League. However, where broadcasting accounted for 70 percent of Newcastle’s income, it ranged between 35 and 49 percent for the Big Six clubs.

Broadcast revenue to rise

In absolute terms, Newcastle’s €146 million in broadcast revenue was less than the Big Six clubs. Coming closest to Arsenal’s €172 million in broadcast revenue. Like Newcastle, the London club failed to qualify for European football in the 2021-22 season. The other Big Six clubs did qualify, with Liverpool generating the most broadcast revenue with €314 million. 115 percent more than the amount Newcastle generated.

In absolute terms, Newcastle’s €146 million in broadcast revenue was less than the Big Six clubs. Coming closest to Arsenal’s €172 million in broadcast revenue. Like Newcastle, the London club failed to qualify for European football in the 2021-22 season. The other Big Six clubs did qualify, with Liverpool generating the most broadcast revenue with €314 million. 115 percent more than the amount Newcastle generated.

By qualifying for the 2023-24 Champions League, Newcastle’s broadcast revenue will thus increase significantly. Would they also consistently compete at the top of the Premier League table, their domestic broadcast income will also rise. As the Premier League’s formula for dividing broadcast revenue is partly based on final league position and the number of televised matches.

Matchday revenue

Arne Müseler / www.arne-mueseler.com, CC BY-SA 3.0 DE, via Wikimedia Commons

Compared to the Big Six, it is matchday and commercial revenue where the club lacks and needs to improve. In 2021-22, the club generated €33 million in revenue from matchdays, the most during the last five seasons (COVID-19 impacted the 2019-20 and 2020-21 seasons).

However, it was just over half of the €64 million City generated in matchday revenue in 2021-22. With City earning the least amongst the Big Six clubs. While Newcastle generated 26 percent of the €126 million in matchday revenue Manchester United generated (the most amongst the Big Six).

With an average league attendance of 51,487 (98 percent capacity) during the season, Newcastle posted similar league attendance figures as Manchester City.

Increasing commercial revenue

The club generated €33 million in commercial revenue during the 2021-22 season. Which was €7 million more than the season prior and €1 million more than during the 2019-20 season.

The club generated €33 million in commercial revenue during the 2021-22 season. Which was €7 million more than the season prior and €1 million more than during the 2019-20 season.

Commercially there is a lot of growth potential, which good on-field performances can stimulate. Manchester City, for example, generated €373 million in 2021-22.

Newcastle made just nine percent of that. However, after City’s takeover by Sheikh Mansour in 2008, their commercial revenue increased more than fivefold from €26 million in 2007-08 to €138.5 million in 2011-12.

New Saudi sponsors

Like City’s new sponsors in the wake of their takeover, the Magpies have struck new commercial deals. Including deals with companies having ties with Saudi Arabia and PIF.

Like City’s new sponsors in the wake of their takeover, the Magpies have struck new commercial deals. Including deals with companies having ties with Saudi Arabia and PIF.

In June 2022, Newcastle announced Saudi based e-commerce platform noon.com as official sleeve partner, replacing tourism company Kayak. This was followed in June 2023, by destination and experiences company Sela becoming the new front-of-shirt sponsor in a reported £25 million per year deal. The previous deal with betting firm FUN88 was reportedly worth £6.5 million per year.

Despite PIF owning both Sela and noon.com, the deals passed the Premier League’s tests. A procedure done to ensure deals are not inflated, but struck at a fair market value, which is determined by a third independent party.

In October 2023, the club announced Saudia as official airline partner for multiple years. During the 2022-23 season, the Saudi Arabian national carrier already partnered with the club as travel partner.

Newcastle United’s Saudi Arabia related sponsorships

| Company | Industry | Since |

|---|---|---|

| Sela | Sporting and entertainment | 2023-24 |

| Noon.com | E-commerce | 2022-23 |

| Saudia | Airline | 2022-23 |

The club’s other partners are betting firms and beverage producers (Carlsberg and Monster Energy). The new deals, with higher values than previous ones, will increase Newcastle’s (commercial) revenue in the coming seasons. Off-setting the rise in wages and will result, when invested into the right squad additions, in on-field success.

Organisational restructuring

A solid structure off-field is just as important to success though, and Newcastle needed to make several improvements. Apart from the appointment of Howe as manager in November 2021, the club appointed Dan Ashworth as new sporting director in June 2022. Ashworth made the switch from Brighton & Hove Albion after Premier League approval and is ‘responsible for the club’s overarching sporting strategy, football development and recruitment at all age levels.’

A solid structure off-field is just as important to success though, and Newcastle needed to make several improvements. Apart from the appointment of Howe as manager in November 2021, the club appointed Dan Ashworth as new sporting director in June 2022. Ashworth made the switch from Brighton & Hove Albion after Premier League approval and is ‘responsible for the club’s overarching sporting strategy, football development and recruitment at all age levels.’

A month later, Darren Eales (previously Spurs, Atlanta United and West Brom) became the club’s new CEO. Working closely with Ashworth, something the two had done previously at West Brom between 2006 and 2010.

To deliver ‘the club’s ambitious commercial growth plans,’ the Magpies appointed Peter Silverstone (previously Arsenal and OneFootball) as Chief Commercial Officer in October 2022.

New personnel in key roles

| Role | Who | Since | Previously |

|---|---|---|---|

| Manager | Eddie Howe | November 2021 | Bournemouth, Burnley |

| Sporting Director | Dan Ashworth | June 2022 | Brighton, West Brom |

| Chief Executive Officer | Darren Eales | July 2022 | Spurs, Atlanta United, West Brom |

| Chief Commercial Officer | Peter Silverstone | October 2022 | Arsenal, OneFootball |

Infrastructure investments

In November 2022, Newcastle announced that the owners invested a further £70.4 million of equity into the club, bringing their total to over £450 million. In addition to playing and non-playing staff, the investments focus on the club’s infrastructure.

In November 2022, Newcastle announced that the owners invested a further £70.4 million of equity into the club, bringing their total to over £450 million. In addition to playing and non-playing staff, the investments focus on the club’s infrastructure.

So far, the club has already updated the training facilities in a bid to raise the standard to Premier League levels. In the long run, however, the Magpies might move to a new location to establish a good basis from which to achieve successes.

There are also development plans for St. James Park in place. The stadium currently has a capacity of around 52,000. But with season ticket demand exceeding supply and league attendance at 98 percent capacity in 2021-22, there is a need for a higher capacity. Co-owner Mehrdad Ghodoussi revealed that the club is looking at expanding the current stadium (to maybe 60,000 or 65,000), rather than moving to a new location. Yet, the stadium’s location in the middle of the city forms a challenge.

For now, the clubs has already ‘enhanced concourse and hospitality facilities, increased connectivity, a new licensed standing area, and proposals for a new fan zone.’

Summary

Newcastle United’s owners seem to be off to a positive start on their long-term journey. They have invested to improve the squad’s quality, with positive on-field performances, restructured the club’s business set-up and have solid commercial growth plans in the pipeline. Now, only time will tell how successful the takeover by the PIF-led consortium will be.