Is Buying Bitcoin and Crypto Currencies Gambling or Investing?

Very few people will not have heard of cryptocurrencies, with the likes of Bitcoin having been in the news for years. There are those that ‘mine’ for cryptocurrency, those that simply trade in it and those that steer as clear of it as possible. It is, in short, a digital currency that works in a similar way as any other currency, as long as the person or business that you’re dealing with accept the use of it for transactions.

Very few people will not have heard of cryptocurrencies, with the likes of Bitcoin having been in the news for years. There are those that ‘mine’ for cryptocurrency, those that simply trade in it and those that steer as clear of it as possible. It is, in short, a digital currency that works in a similar way as any other currency, as long as the person or business that you’re dealing with accept the use of it for transactions.

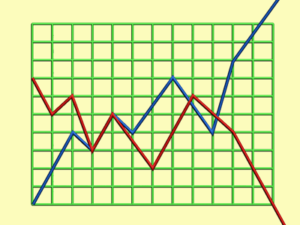

The reality is that the volatility of cryptocurrencies means that investing in them is, in and of itself, a form of gambling. Investing in Bitcoin is something of a rollercoaster ride, given the extent to which shares of it can plummet and soar in equal measure. Warren Buffett, the legendary investor, called it ‘rat poison’ and advised people to steer clear of it, so are those that engage in the buying of crypto currencies gamblers or investors?

A Highly Volatile Investment

The truth about crypto currencies is that they are extremely volatile, which is a financial term that suggests that the price of a crypto currency as any asset will vary wildly. An investment that has a high degree of volatility has an associated high risk involved, which is why many people are of the opinion that investing in it is essentially gambling but coming under a different title.

The truth about crypto currencies is that they are extremely volatile, which is a financial term that suggests that the price of a crypto currency as any asset will vary wildly. An investment that has a high degree of volatility has an associated high risk involved, which is why many people are of the opinion that investing in it is essentially gambling but coming under a different title.

Of course, there are plenty that would suggest that any investment is a gamble, with crypto currency being no exception. Yet it is that readily accepted high volatility of crypto currency that makes it even more of a risk than most other forms of investment. There is certainly a comparison to be made between investing in crypto currencies and a form of gambling, but it’s which type of gambling you choose for your comparison that is key.

It’s More Like Poker Than Roulette

When looking at crypto currencies as a form of gambling, it’s probably fair to say that it has more in common with poker than the likes of roulette. That is a game that is essentially entirely random, whereas in poker you can know whether or not you’ve got a good hand. Of course, having a good hand doesn’t guarantee victory in poker just as buying crypto currency at a good time doesn’t mean that you’ll be guaranteed a profit.

When looking at crypto currencies as a form of gambling, it’s probably fair to say that it has more in common with poker than the likes of roulette. That is a game that is essentially entirely random, whereas in poker you can know whether or not you’ve got a good hand. Of course, having a good hand doesn’t guarantee victory in poker just as buying crypto currency at a good time doesn’t mean that you’ll be guaranteed a profit.

When you’re playing something like Texas Hold’em poker, there are a number of outside influences that you can do nothing about. Similarly in the world of crypto currencies, there are all sorts of outside influences that can change the value of your investment when you can do nothing about it. You can decide to ‘fold’ your investment by selling it, or you can hold on to see what comes next. There’s a similarity, but not a direct link.

It’s All About Perception

There’s an argument that someone’s opinion on whether or not crypto currency is an investment or a gamble will depend on your perception. Of course it’s easy to know that putting £1,000 in an ISA is an investment, whilst betting £1,000 on red on the roulette table is a gamble. But what about if you know someone that is setting up a business and has asked for £1,000 in investment?

There’s an argument that someone’s opinion on whether or not crypto currency is an investment or a gamble will depend on your perception. Of course it’s easy to know that putting £1,000 in an ISA is an investment, whilst betting £1,000 on red on the roulette table is a gamble. But what about if you know someone that is setting up a business and has asked for £1,000 in investment?

There’s no guarantee that your friend’s business will be a success, so giving them your £1,000 always carries a degree or risk. If they make it a success then you’ll be able to claim a profit, whilst if they get it wrong then you could lose your £1,000 and not be able to do anything about it. It’s not a dissimilar thing when it comes to buying crypto currencies, so whether you think it’s an investment or a gamble will depend on your point of view.

What Is The Difference Between Investing & Gambling?

Perhaps something that strikes to the heart of this issue is what the actual difference is between investing and gambling, even aside from a discussion around crypto currencies. Both investing and gambling asks those involved to put their capital at risk in the hope that they’ll be able to make a profit. Similarly, the key principle of both activities is to minimise your risk whilst maximising your potential reward.

Perhaps something that strikes to the heart of this issue is what the actual difference is between investing and gambling, even aside from a discussion around crypto currencies. Both investing and gambling asks those involved to put their capital at risk in the hope that they’ll be able to make a profit. Similarly, the key principle of both activities is to minimise your risk whilst maximising your potential reward.

When it comes to differences, investing has more opportunity to mitigate losses than gambling does, in addition to the fact that investors have more sources from which they can gain relevant information than gamblers. As an investor, the odds are generally in your favour when looked at over a long period of time, whilst the opposite is the case for gamblers. How do those facts work alongside crypto currencies?

For investors in crypto currency, they can read the tea leaves of what makes the currency’s value go up or down and act accordingly. The same cannot be said for gamblers, who will likely never know when a bet is likely to be a winner or loser in the majority of circumstances. Equally, crypto currency investors can look to invest in other areas that will allow them to cover any losses, which gamblers can’t do.

Do You Pay Tax On Bitcoin / Crypto Profits?

Of course many that do invest in cryto currency are looking at the shorter term trying to make profit from the high volatility of the markets. These currencies are highly volatile because they are not pinned down against a nation state, which means there are less checks and balances to control currency movements.

Of course many that do invest in cryto currency are looking at the shorter term trying to make profit from the high volatility of the markets. These currencies are highly volatile because they are not pinned down against a nation state, which means there are less checks and balances to control currency movements.

Conversely because cryto currencies are not classed as central currency means the HRMC does not does not consider it to be a currency or money. Therefore, most people hold bitcoin in a personal account and in this case if you make a profit you will be liable to pay Capital Gains Tax. This will only apply above £12,300 (2020/21).

You are unlikely to need to pay income tax on bitcoin profits, unless you are doing it on such a regular basis that it can be classed as your job. In this case you may be deemed a trader and need to pay appropriate income tax. Generally, though, crypto investments are treated the same as those in shares and securities and fall under the rules of Captial Gains Tax.

Basically if you are trading crypto to a low level and making less than £12,300 a year on your total Captial Gains then you will not be liable for tax. If you are liable for tax you need to fill out a self assessment and even if you are not liable to pay tax and you already submit a self-assessment you should include any profits on there.

Note that there is a 30 day repurcahse rule. This basically means if you sell a currency and then repurchase within 30 days it will change the profit calculation (positive or negative).

Tax On Mining Bitcoin

If you mine Bitcoin, or similar, you will receive any coins you mine for free but tax is payable on the market value of the received coins.

As with trading the currencies you will only be liable for tax if you are doing this on scale, and acting as a trader. Basically if you have banks of computers mining Bitcoin it is likely you will need to pay tax.

Similar to other forms of income, though, you can subtract relevant costs that can be deducted against any income. If you retain your mined coins and they increase in value and you sell them you again may be liable to pay Capital Gains Tax.

What The Experts Say

When considering any topic, it is always worth looking at what the experts think about the matter. Charlie Beach is employed by Lendingblock, a crypto currency platform. His watch phrase when speaking to people about it is ‘caveat emptor’, or ‘buyer beware’. Speaking on the matter he said,

“Bitcoin is an investment only suitable for the sophisticated investor and even then only as a small part of any portfolio.”

The reasoning behind his thinking is that crypto currencies are just as liable to take a hit as any other form of stock. As an example, Ethereum is an alternative to Bitcoin and a purchase of £900 worth of it a couple of years ago would be worth about £160 now. Crypto currencies have ‘no real application’, lacking anything tangible that investors can hang on to. Instead, it’s similar to a slot machine that will pay out sporadically but doesn’t guarantee anything.